Numerous times when conversing ATM Cash Management the focus of the discussion turns to, “In what way good is your forecast? The forecast is one small piece of ATM Cash Management. In maximum cases, what has happened over the last 30 days at an ATM can offer an active forecast: just add up what has been withdrawn for the ATM and divide by 30. That will give you a per-day cash requirement.

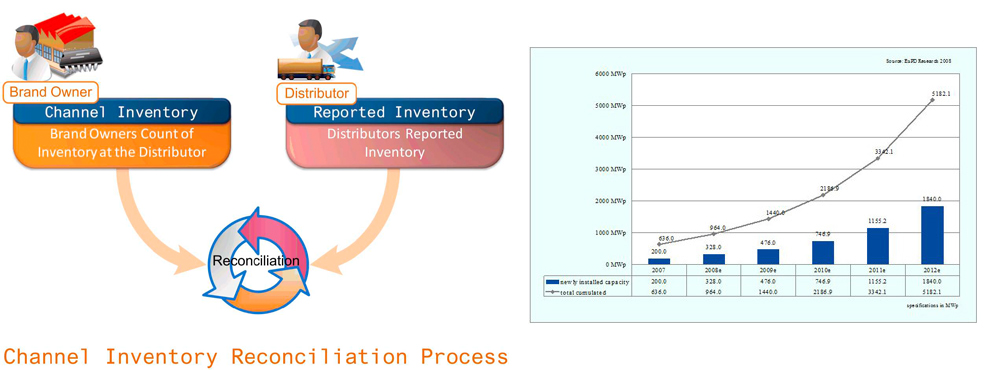

The reconciliation of this ATM needs deeper understanding:

- Pursuing the cash going into an ATM – the cash loads.

- How much money has been withdrawn from the ATM, (including partial day 1 and partial day 8 amounts as the armored company most likely loads the ATM mid-day.)

- The money returned from the ATM – from Load 1.

This reconciliation can get difficult. Without a systematic understanding of the day-to-day activities at the ATM, it is easy for the ATM to “go out of balance.” Numerous times you are dependent on ATM cash reporting from the reinforced company.

If this is unpredictable, one of two things usually happens:

- A lot of time and resources are spent to reconcile the ATM(s).

- The out of balance is overlooked and more cash is ordered—usually more than is necessary—which eventually increases the costs of running the ATM(s).

Forecasting is one small piece of active ATM Cash Management. The larger process that delivers clear discernibility and tight control of the movement of cash from cash load to cash load can “make or break” your opportunity to run effectual, profitable ATMs. Moderately than a singular focus on forecasting, a broader perception and application of the detailed analysis required to tighten the Cash Cycle can assistance drive greater success at the ATM.

Automatic teller machines are handy when you require cash on the fly and you are not near your bank. The problem is that if you are not careful, you can run into real difficulties when you become overdrawn on checks because of the cash you withdrew from an ATM. You can also undertake you have less money in your account than in reality if you do not take into account deposits you have made through an ATM. To correct the problem, you require to create a system to reconcile ATM transactions.

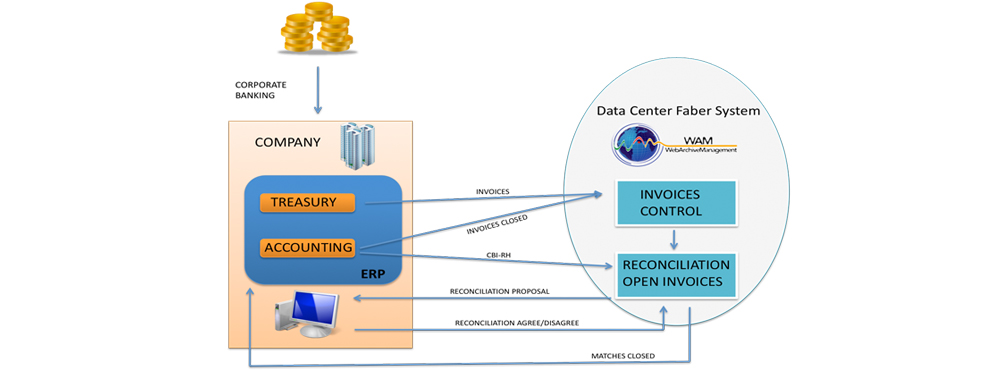

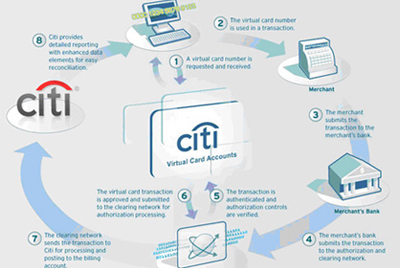

The ATM Reconciliation and ATM Compare programs both automate the daily balancing of the ATM network. Once the transaction report from the Data Processing system and the ATM Network report file are downloaded to a PC's disk the program loads the transactions, run's the reconcilement program and generate a report of unmatched items between the two systems.

The ACE Report Activity Analysis program is the newest separately available piece of the ATM Reconciliation program suite of tools. The Report Activity Analysis tool loads the transactions from the Incurable or Member activity reports and provides a wide range of summary an analysis competences. These can be modified for the customer at a very negligible cost. The standard reports contain a summary of Terminal activity by ATM, cutoff carry over calculations, member against non-member activity and fee totaling. For member activity reports the program can scan for large transactions above any threshold desired as well as accounts with heavy activity.

The ATM Compare program is designed for the smaller institution having just one Network to balance with the Network driving a small number the ATM machines. This easy to use program rapidly loads transactions from the network activity report and DP system activity report, compares them and offers a list of unmatched transactions to research and resolve. This is normally the most time consuming part of balancing the ATM activity each day.

The ATM Reconciliation program contains both of the tools above and is fully customized for each customer. In addition to the comparison report can capture GL transaction amounts for the daily balancing of the network, the institutions ATM's, etc. The program can support multiple balancing end points, interrupt processors foreign and cardholder activity, compare individual network transactions from combined reports or any other comparison or selection principles the institution might have. Additions to the program have been done to capture and post service charges for ATM inquiries and check cashing at Shared branches, to report large deposits and withdrawals, accounts with a lot of activity on a day, capturing of credit union and individual ATM balancing items from the network reports, totals of activity by ATM per month, etc. There is even a Cash balancing feature for following the Cash in the ATM and confirm the balance when it replaced over a time period from daily to weekly or extended.

Important Benefits

- Reports transactions not found on DP system and ATM switch.

- Captures Information from the reports and files you already use, NO custom interfaces or extracts obligatory.

- Eradicates printing the ATM and DP system transaction reports.

- Search and review transactions in online screens.

The main benefits of working with Reconciliationaccounting are below:

Consistent Data Source – Reconciliationaccounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: Reconciliationaccounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work – Main benefits of Reconciliationaccounting work is to get high quality work as per your needs with reasonable rates.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of Reconciliationaccounting.

We work 24/7 days for more details feel free to contact us at any time you required.