Inter company reconciliation

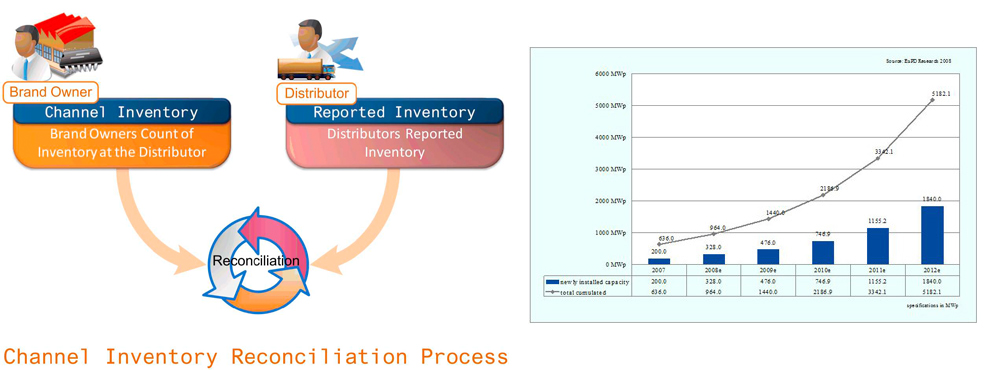

Inter company reconciliation is reconciling among the two branches of the same company located in multiple locations. Where as one branch acts as seller to other branch when some product is moved from Branch A to B branch.

Eg:-when Branch A sends some products to Branch B then in this case. Branch A becomes the seller and Branch B becomes the purchaser.

Hence we require to reconcile between these two branches to make sure the right figures appear on the financial statements to the management.

Reconciling Intercompany Accounts

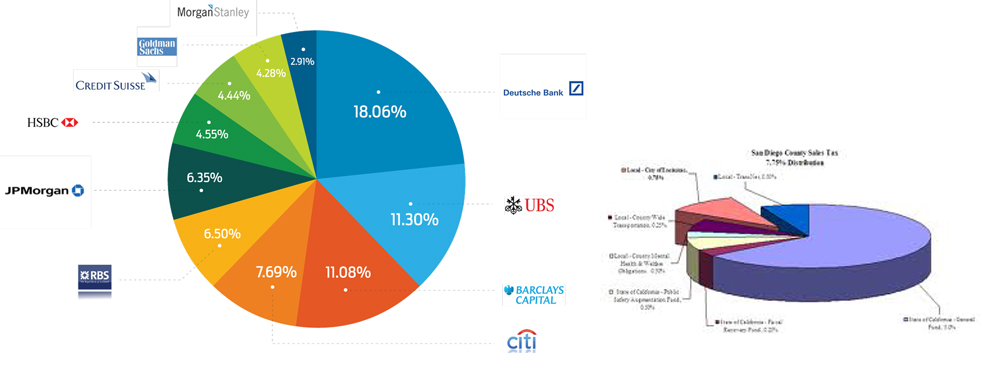

Intercompany accounts are accounts in an organizations' General Ledger that represent a balance of payments due from, or to, entities related by common ownership or control. For example, If company "A" makes widgets and sells them for $100 to a sister-company, company "B", an intercompany relationship exists, or must exist, in the General Ledger where Company "B" has an Intercompany Payable to Company "A" and, conversely, Company "A" has an Intercompany Receivable from Company "B".

At the end of each month, the consolidated Intercompany Accounts Receivable and Intercompany Accounts Payable should have the same balances, a debit for the Intercompany A/R and a credit for Intercompany A/P.

ProblemNumerous firms have reconciliation issues related to intercompany accounts. For many, this problem can cause the books to be kept open for days or weeks longer than required. I know of a company where it was not infrequent to have the intercompany accounts out of balance through several million dollars every month. Unless a company institutes the suitable controls to keep the balances in check, the problem will continue to grow and as it multiplies, it will become completely incontrollable.

The causes for these out-of-balance situations frequently start out very small - If Company "A" from the previous section sells a widget to Company "B" for $100 and charges $10 freight, but the Purchasing Dept for Company "B" tells their Accounts Payable Dept that it's not on the Purchase Order, so we aren't paying it, the company will have an out-of-balance situation if the issue is not determined through the end of the month. Numerous companies also pass an intercompany charge to their subsidiaries based upon their Working Capital as an encouragement to keep Working Capital as low as possible to evade unwarranted intercompany charges. If there is a disagreement in the calculation, this might also cause an imbalance in the Intercompany Accounts. Any deficiency of clarity on the part of the entity passing the charge, or a lack of acceptance on the part of the entity receiving the charge, has the potential to cause an out-of-balance situation.

ResponsibilityThrough definition, the responsibility for confirming that Intercompany Accounts (or any accounts, for that matter) rests confidently with the Controller of the organization. Some organizations might not have a person with the title of Controller, but it is frequently apparent who the person is who carries out the controllership functions. In effectively all organizations, the Controller must own the Balance Sheet of the organization and be the guardian of the financial policies and techniques. Through extension, as the Controller must own the Balance Sheet and support the reconciliation procedure, executive management i.e. CFO, CEO, Vice Presidents, etc. should support the Controllers' authority to implement the timely reconciliation of the Intercompany Accounts.

Utmost organizations that develop intercompany issues have a matrix or semi-matrixed reporting structure. This circumstance has the offensive habit of splitting allegiances. It should be clear that the Corporate Controller for the parent company is the final mediator in the reconciliation of Intercompany Account arguments with and between subsidiaries, unless the resolution is in violation of a law.

ResolutionEstablishing an environment that has an operative intercompany reconciliation process hinges on education. The education, still, must be preceded by top-down policies.

These must include, but not limited to:

- Responsibility for reconciliation

- Responsibility for internal control

- Particular format for reconciliation

- Foreign currency policies

- Intercompany cut-off policies

- Transfer pricing policies

- Formal confirmation policy & procedure

- Dispute resolution policy & procedure

- General procedure for reconciliation

Subsequently policies are in place (and controlled), the suitable personnel will require training, from the top of the Accounting hierarchy to the bottom. Particularly when originally realized, the policies and processes must be reviewed regularly to make sure that they address common company-specific issues that arise during the first few months of implementation. Great care must be exercised, still, to make sure that policies aren't changed simply to confirm compliance. Each time the policies are reviewed due to an issue, the question should be asked as to whether the problem lies in the policy, the processes or the procedure. After effective policies are recognized and rolled-out through the organization, the issues that arise will normally deal with procedure or process issues. Remember, the policies are in place as a protection for the organization and the basis for processes and procedures that comply with the policy.

What if you're already down the road and have a huge reconciliation mess to resolve? The same laws of intercompany reconciliation still hold true. Policies, education, processes and procedures should be put into place to stop the hemorrhaging and the existing mess must be cleaned up. This should be attempted first with existing personnel with the explicit statement that if the accounts do not balance per company policy through a quantified date, that a "fire team" will be assembled to assistance the entities in the reconciliation procedure. This will typically be enough encouragement to get the accounts in order for the majority of entities, because nobody wants Corporate to show up and start helping - that is probably second only to the IRS showing up to assistance.

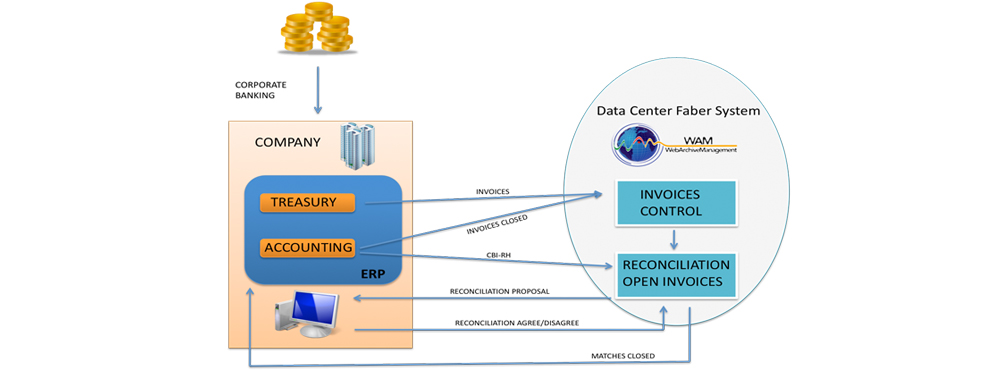

Early it was noted that several of the technology solutions can be more cumbersome than a company's current procedures. We are not saying that technology can't help; technology can help or augment if you have operative policies, but the policies should be in place, must be operative, and must be required or the technology solution will just be more constituents added to a rotten soup.

Frequently, in this lean world, Corporate doesn't really have the man-hours to spare to address these reconciliation issues among the operating objects. In this situation, a third party can help in the reconciliation procedure or in troubleshooting the policies, processes and procedures to make sure a reliable process for intercompany reconciliation.

The main benefits of working with Reconciliationaccounting are below:

Consistent Data Source – Reconciliationaccounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: Reconciliationaccounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work – Main benefits of Reconciliationaccounting work is to get high quality work as per your needs with reasonable rates.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of Reconciliationaccounting.

We work 24/7 days for more details feel free to contact us at any time you required.