Trust Accounting is thoughtful business. You require to make sure that your trust account records are complete and in compliance with your state bar association requirements. Most states need at the minimum monthly back reconciliations, activity detail reports and customer ledgers reflecting individual customer balances in the trust account.

Like most Advocates, you don't have enough hours in the day to get everything done that desires to be completed and we know how significant keeping your Trust Account reconciled and up to date is, our Trust Account Reconciliation Service is for you. We will reconcile your trust bank account monthly and print the reports that your state bar necessitates you have on hand to show that you are in compliance with Trust Account regulations.

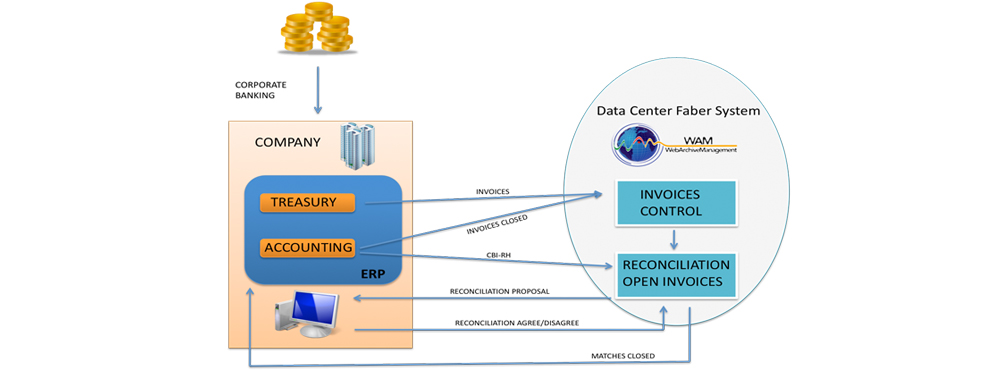

We can complete the work distantly, or you can forward us the information in the mail and we will complete the reconciliation, create the reports and forward them back to you. We can walk you through our procedure to show you accurately what we are doing and as always you will have full control over the data.

In light of the recent, considerable drop in interest rates, most trustees' trust accounts are no longer earning interest. Prior to this decline, interest earned on a trust account meant that there was at least one transaction per month on the account, and a bank statement was issued. Presently, still, some financial institutions do not issue a monthly statement when there has been no activity on the account. This means that trustees are not receiving a bank statement upon which to base their monthly trust account reconciliation.

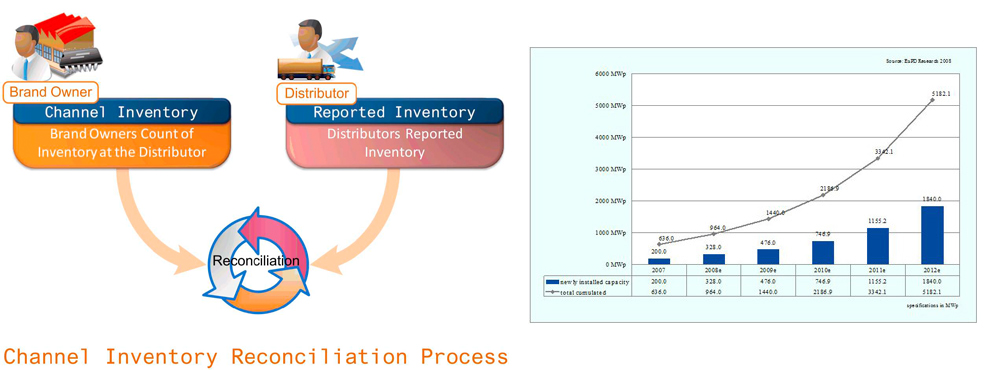

A trust account reconciliation completed by a trustee in the bankruptcy and insolvency context is a procedure that confirms that the trustee's records and the financial institution's records precisely reflect the amount of money in the trust account.

A proper trust account reconciliation offers the trustee with some assurance that there have not been any mistakes in the handling of funds in the trust account.

Exactly, a trust account reconciliation is completed to:

- Approve deposit transactions that occurred in the account;?

- Approve that current account balances match balances shown on the previous bank statement;

- Update the list of outstanding cheques; and

- Avoid any deceitful activity on the account.

Based on the previous, trustees must complete a monthly trust account reconciliation for the trust account(s) opened for each estate to which they are appointed, irrespective of the activity on the account(s) and irrespective of their financial institution' practice with respect to issuing monthly bank statements.

The main benefits of working with Reconciliationaccounting are below:

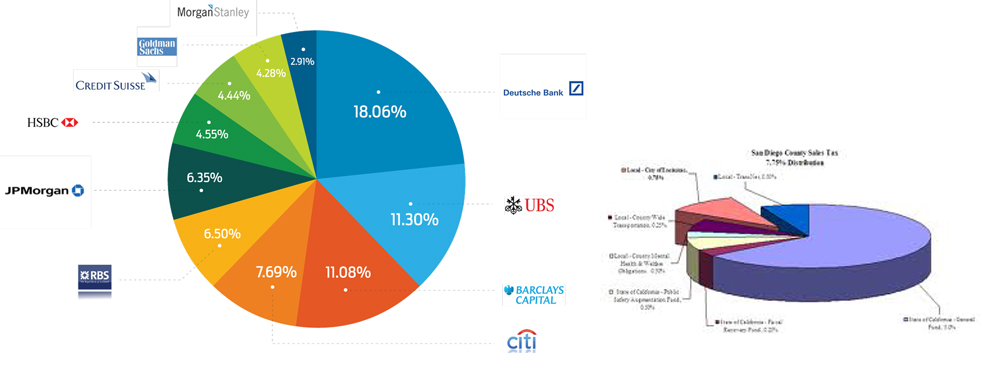

Consistent Data Source – Reconciliationaccounting business give you consist and precise data which can be easily used for the benefits of the decision-making desires. This in turn guarantees competence in workflow and there is no expenditure of time.

Maximize your ROI: Reconciliationaccounting work give significant cost reduction and gives you high Return of asset.

High Superiority Work – Main benefits of Reconciliationaccounting work is to get high quality work as per your needs with reasonable rates.

Securities, Uniformity, Rapid growth, Speed, services and improve customer satisfaction, improved presentation, Backend effective work environment these are main goal of Reconciliationaccounting.

We work 24/7 days for more details feel free to contact us at any time you required.